Home > Industries > AI and ML: The Future of Banking

AI and ML: The Future of Banking

Artificial intelligence (AI) and machine learning (ML) are rapidly transforming the banking industry. These technologies are being used to automate tasks, improve customer service, and make better decisions.

Examples of AI and ML in Banking

- Fraud detection: AI and ML can be used to identify fraudulent transactions. This can help banks to protect their customers and their financial systems.

- Risk assessment: AI and ML can be used to assess the risk of lending to a particular customer. This can help banks to make better lending decisions and reduce their risk of default.

- Customer service: AI and ML can be used to provide customer service chatbots. These chatbots can answer customer questions and resolve issues 24/7.

- Personalization: AI and ML can be used to personalize the customer experience. This can be done by recommending products and services that are tailored to the customer’s needs.

Facts and Figures

- A recent study by McKinsey found that AI could add $1.4 trillion to the global banking industry by 2030.

- The global market for AI in banking is expected to grow from $2.6 billion in 2020 to $12.2 billion in 2025.

- 75% of banks are already using AI in some form.

- The most common use cases for AI in banking are fraud detection, risk assessment, and customer service.

How Elements Next Generation Can Help Banks in UAE, Saudi Arabia, and the GCC

Elements Next Generation is a digital transformation firm that helps banks in the UAE, Saudi Arabia, and the GCC to utilize AI and ML. We offer a wide range of services, including:

- Consulting: We help banks to develop AI and ML strategies that are aligned with their business goals.

- Implementation: We help banks to implement AI and ML solutions that are scalable and secure.

- Training: We provide training to bank employees on how to use AI and ML solutions.

We have a proven track record of helping banks in the UAE, Saudi Arabia, and the GCC to utilize AI and ML. We have helped banks to improve their fraud detection, risk assessment, and customer service. We have also helped banks to personalize the customer experience and increase their revenue.

Conclusion

AI and ML are transforming the banking industry. These technologies are being used to automate tasks, improve customer service, and make better decisions. Elements Next Generation is a digital transformation firm that helps banks in the UAE, Saudi Arabia, and the GCC to utilize AI and ML. We offer a wide range of services, including consulting, implementation, and training. We have a proven track record of helping banks in the region to utilize AI and ML.Contact Us

If you are a bank or a FinTech start up in the UAE, Saudi Arabia, or the GCC and you are interested in learning more about how Elements Next Generation can help you to utilize AI and ML, please contact us today. We would be happy to discuss your needs and how we can help you to achieve your business goals.Our Approach

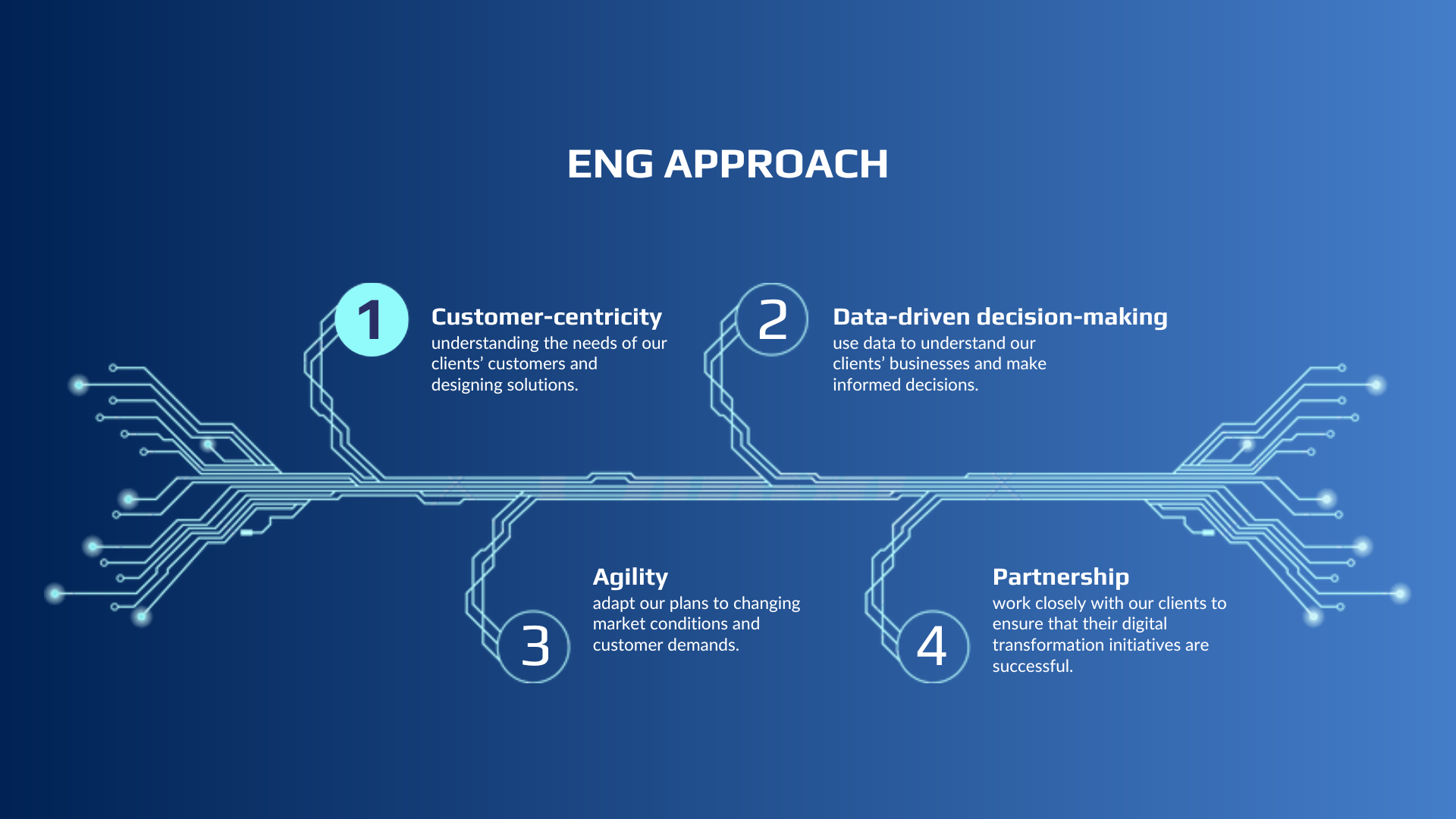

Our approach to digital transformation is based on the following principles:

- Customer-centricity: We focus on understanding the needs of our clients’ customers and designing solutions that meet those needs.

- Data-driven decision-making: We use data to understand our clients’ businesses and make informed decisions about which digital transformation initiatives to pursue.

- Agility: We are able to adapt our plans to changing market conditions and customer demands.

- Partnership: We work closely with our clients to ensure that their digital transformation initiatives are successful.